INVEST WITH CARPATHIAN CAPITAL MANAGEMENT (CCM)

Unlock High-Impact, High-Return Real Estate Investments with CCM Development Fund III

Bring much-needed homes to thriving communities while leveraging decades of industry expertise to capture attractive risk-adjusted returns, targeting steady cash flows and compelling total returns.

What is CCM Development Fund III?

The Residential Development Opportunities Fund III is Carpathian Capital Management's strategic investment vehicle designed to capitalize on the acute housing shortage in high-growth U.S. markets.

This sophisticated fund combines Carpathian's deep industry expertise with carefully selected residential development opportunities across the United States.

The Fund primarily invests in joint ventures with proven best-in-class operators, offering accredited investors a unique blend of current income, capital appreciation potential, and portfolio diversification.

With a target net IRR of 15-20% and a quarterly distribution option, the Fund aims to generate compelling risk-adjusted returns. Simultaneously, it plays a crucial role in addressing the housing crisis by providing essential capital to bring much-needed new homes to thriving communities.

Carpathian Capital Management made the Inc. 5000 List for the first time in 2022.

Carpathian Capital Management was featured in its inaugural year on the Inc. 5000 – ranked 4124th on the list, growing revenue by an average of 114% over the prior three years. This growth has been overseen by company CEO Ian Colville and COO Matt Forster. CCM’s growth has been predominantly driven by its Joint Venture Equity Development funds and Private Lending investment fund (focusing on new home builders) Read more >

Investment Opportunity with CCM Development Fund III

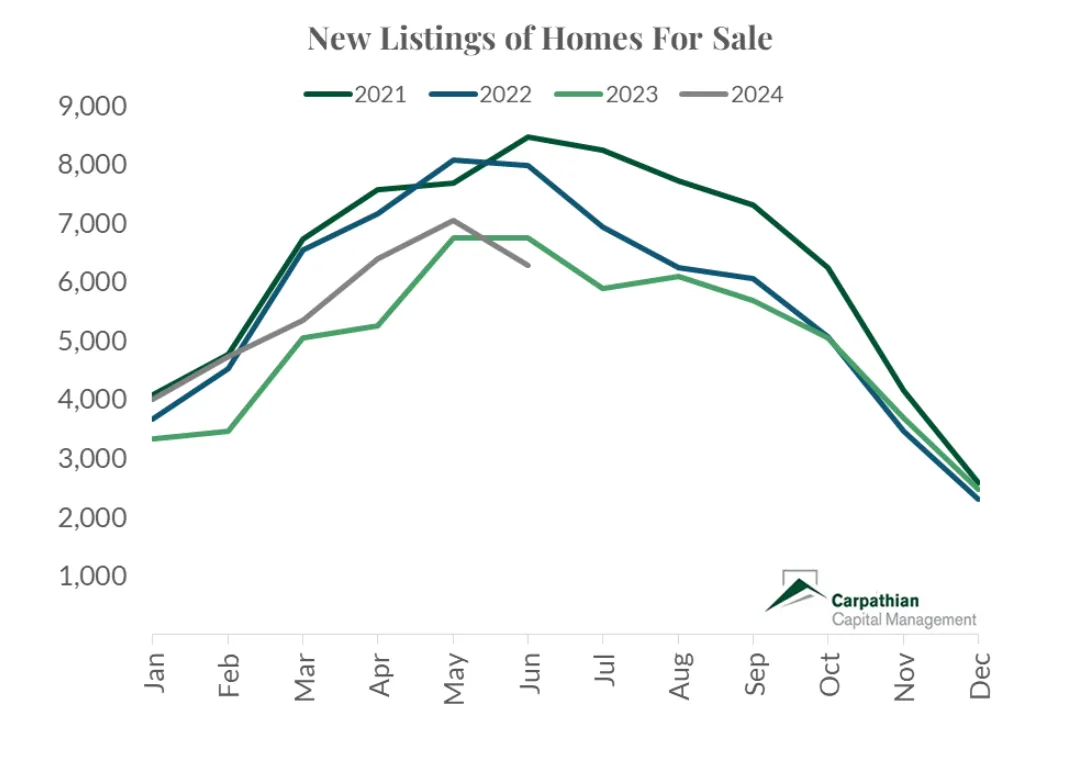

Supply of homes is near a multi-decade low

Regional builders need equity to deliver projects

Single-family home construction collapsed during and after the housing crisis (2008-2012) leading to a big shortage.

More recently, higher interest rates have led to rapid decline in housing and construction projects. Shortages will likely be even worse in 12 months.

Sellers have largely exited the market as they are “locked in” to low-rate mortgages on current homes, adding to the shortage of housing.

Regional builders need equity to deliver projects

Many independent developers left the business after housing crisis.

National home builders have expertise but have kept land development off their balance sheet since the financial crisis by outsourcing to third parties.

Banks have been more reluctant to lend money on land development projects since the housing crisis.

Private, regional builder/developers need capital from outside sources to get deals done and ensure on-time project delivery.

Why invest in Real Estate?

Potential for Strong Returns: Real estate development can offer attractive risk-adjusted returns, with our fund targeting 15%-20% net IRR.

Inflation Hedge: Real estate values and rents tend to increase with inflation, helping to preserve wealth over time.

Portfolio Diversification: Real estate typically has low correlation with stocks and bonds, enhancing overall portfolio stability.

Tangible Asset: Unlike stocks or bonds, real estate is a physical asset, providing a sense of security and real-world impact.

Societal Impact: Investing in residential development addresses critical housing shortages, allowing investors to generate returns while contributing to community growth.

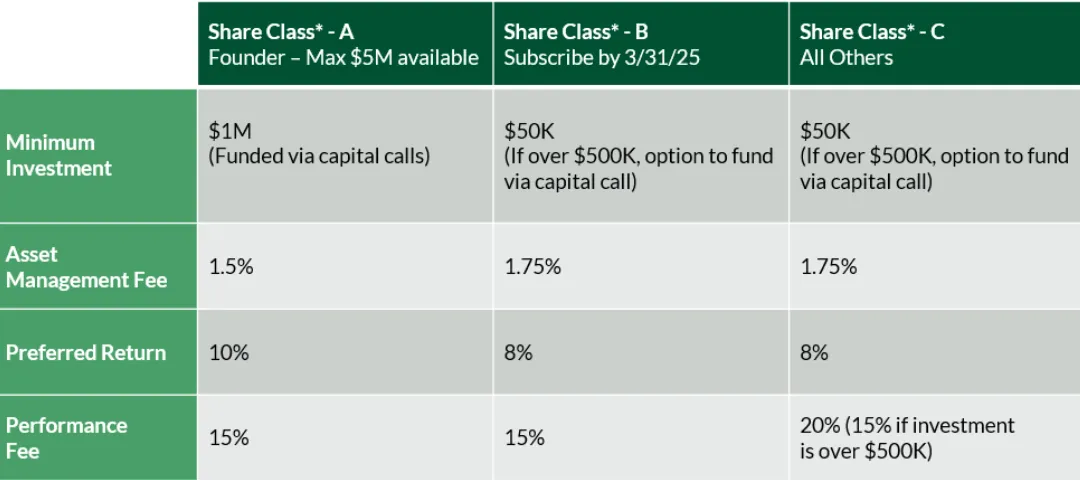

Share Class Structure - CCM Development Fund III

Target returns: 15%-20% Net to Investors

Fund Type: Open-ended with quarterly subscription window*

Distribution Option: Quarterly

Liquidity for Redemptions: Semi-annually**

Minimum Investment: $25,000

*Manager may place a cap on subscriptions in any given quarter based on project pipeline.

** Liquidity for all share classes: semi-annual with 180 day calendar notice, after one-year lock up subject to a 5% Fund-level gate and available cash.

Benefits of investing with Carpathian Capital Management

Proven Expertise

Carpathian Capital Management's team brings decades of experience in real estate development, investment banking, and asset management.

Exclusive Opportunities

CCM's extensive network provides investors access to high-potential real estate projects that are typically unavailable to individual investors.

Rigorous Due Diligence

Our thorough vetting process gives peace of mind to both operating partners and individual projects, significantly reducing investment risk.

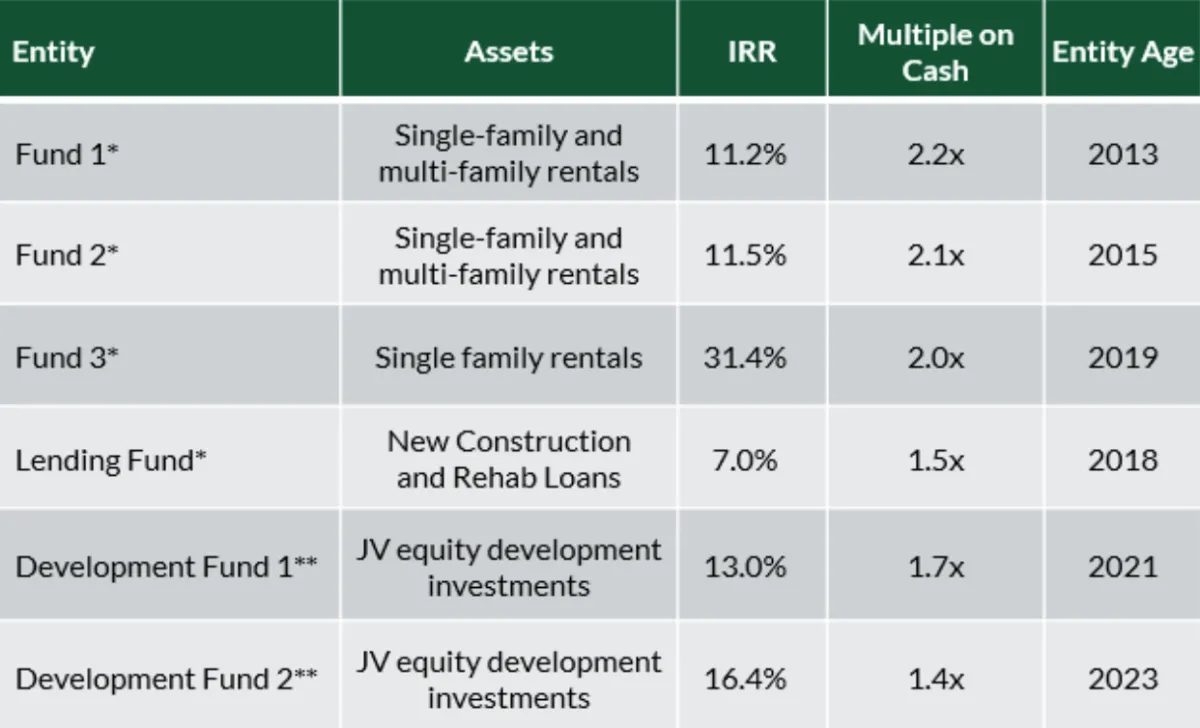

Strong Track Record

Investors can trust in CCM's demonstrated success across multiple funds, projects, and real estate investment opportunities since inception in 2012.

Robust Risk Mitigation

We utilise conservative underwriting, structured investments & diversification, provide additional protection for investor capital.

Scalability

Investors can participate in large-scale development projects that would be unfeasible for most individuals, potentially leading to higher returns.

Best-in-Class Partnerships

Investors benefit from CCM's collaborations with top developers and home builders, leveraging local expertise for optimal project execution.

Transparent Reporting

Carpathian provides regular quarterly updates to investors, ensuring investors stay well-informed about their investment's performance.

Carpathian Capital Management's Track Record

Asset values and IRR as of March 31st, 2024

* Active as of 2024

** Active - Projected through investment duration

Secure Access to Unparalleled Real Estate Investments

At Carpathian Capital Management, we offer our investors exclusive access to unique real estate investment opportunities with high returns. Contact us now to unlock tailored investment solutions and secure your financial future!

Meet our Executive Team

Ian Colville

Managing Partner & CEO

Ian has ten years of real estate investing experience, ten years of banking and seven years of management consulting experience.

Eric Bialke

Sr. Director Real Estate Joint Ventures

Eric is a joint ventures expert with ten years of experience at Mountain Real Estate Capital and ten years as Investment Manager at GMAC-RFC.

Matt Forster

Chief Operating Officer

Matt has twenty years of operations and executive leadership experience, including executive positions with three startups.

Steve Nolander

Sr. Director of Commercial Lending

Steve has twenty years of lending and joint venture equity experience, focusing on home builder lending and residential real estate.

Frequently Asked Questions (FAQs)

What is an accredited investor?

Accredited investors must meet any of the following criteria:

- A net worth of at least $1 million, either alone or together with a spouse or spousal equivalent (excluding the value of the person's primary residence)

- Earned an income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year

- A Series 7, 65, or 82 license in good standing

What is the minimum investment?

The minimum investment is $25,000.

What are the expected returns?

The fund targets a net Internal Rate of Return (IRR) of 15%-20%.

IRR is a measure of the profitability of an investment, expressed as an annualized percentage rate. It calculates the effective interest rate at which the initial investment grows over time, considering all the money invested and returned.

How often are distributions made?

Distributions are made quarterly.

What is the liquidity like?

Liquidity for redemptions is semi-annual with a 180-day notice after a one-year lock-up period, subject to a 5% Fund-level gate and available cash.

Carpathian Capital Management debuted on the Inc. 5000 list of America's fastest growing companies in 2022. Privacy Policy